It’s still too early to predict the effect that Brexit will have on energy consumers in the U.K., but throughout the European Union, the cost of electric power continues to range wildly. Denmark, Germany and Spain have some of the most expensive electricity. Taxes account for the highest proportion of the final price in Denmark (69.1 percent) and Germany (51.6 percent).

When it comes to the way they pay their energy bills, most European electricity customers continue to pay the traditional way (a single rate with payment at the end of each month). Yet, in recent years, some European energy providers have begun to explore variable payment options that expose the real costs of power and make it easier for their customers to manage their energy consumption.

“There are many different contracts that are targeting specific customer segments,” says Peter Mueller, Head of Product at Landis+Gyr AG. In the U.K., where full competition was introduced into energy markets for domestic customers in 1998, energy providers are getting creative with offers to their residential customers.

“British Gas, for example, recently introduced a contract in which they provide energy for free on a Saturday or Sunday,” says Mueller. “Germany, which has the most expensive power in Europe, offers critical peak rates, or time-of-use (TOU) rates that divide the day into two rate pockets. When you sign with the utility, you’re informed about the hours that are involved in those two rate periods.”

Scandinavia and the Spot Market

In Sweden and other Scandinavian countries, spot market prices — hourly rates divided into rate pockets — are posted a day ahead for consumers who choose to purchase power that way. “They tell you what they’re going to charge you hour-by-hour for the next day, so consumers have a chance to use that information to heat their houses in the most cost-efficient way and optimize their consumption,” says Mueller. “They’re taking energy trading and exposing it to consumers directly, as opposed to manipulating it ahead of time.”

In Finland, where there is a smart meter for virtually every home in the country, residential electricity consumers can tap into the spot market to manage their energy consumption and their energy bills. Ari Tolonen, CEO of Landis+Gyr, Finland, is a spot market customer. “Every day at 2:00 p.m., next-day prices are introduced online, so my home energy management system can automatically plan the heating procedures for my house based on that price indication,” he says.

The installation of AMI networks in Finland, which was completed in 2013, made possible a wide range of systems and pricing policies. Spot market pricing was launched at the beginning of 2014 and now has a market share of approximately 3 to 5 percent, according to Tolonen. “I believe it will increase dramatically in the years to come,” he says. “It’s a system that’s based on exposing the real costs of power, so consumers can manage their energy accordingly, as opposed to just averaging out the costs over the day,” he says.

Prepay — a persistent challenge

Unlike the U.K., where approximately 4 million customers, or about 15 percent of the customer base, are prepay customers, only a small proportion of European Union customers have chosen the prepay option. “If you talk about Europe as a whole, prepayment is a pretty small application overall,” says Mueller.

One exception may be the Netherlands, where late payments are a growing problem among some customers segments. Energy suppliers in this region are hoping to leverage the capabilities of smart meters to launch smart meter-based prepay programs. In 2014, EnergieFlex launched the first prepay service.

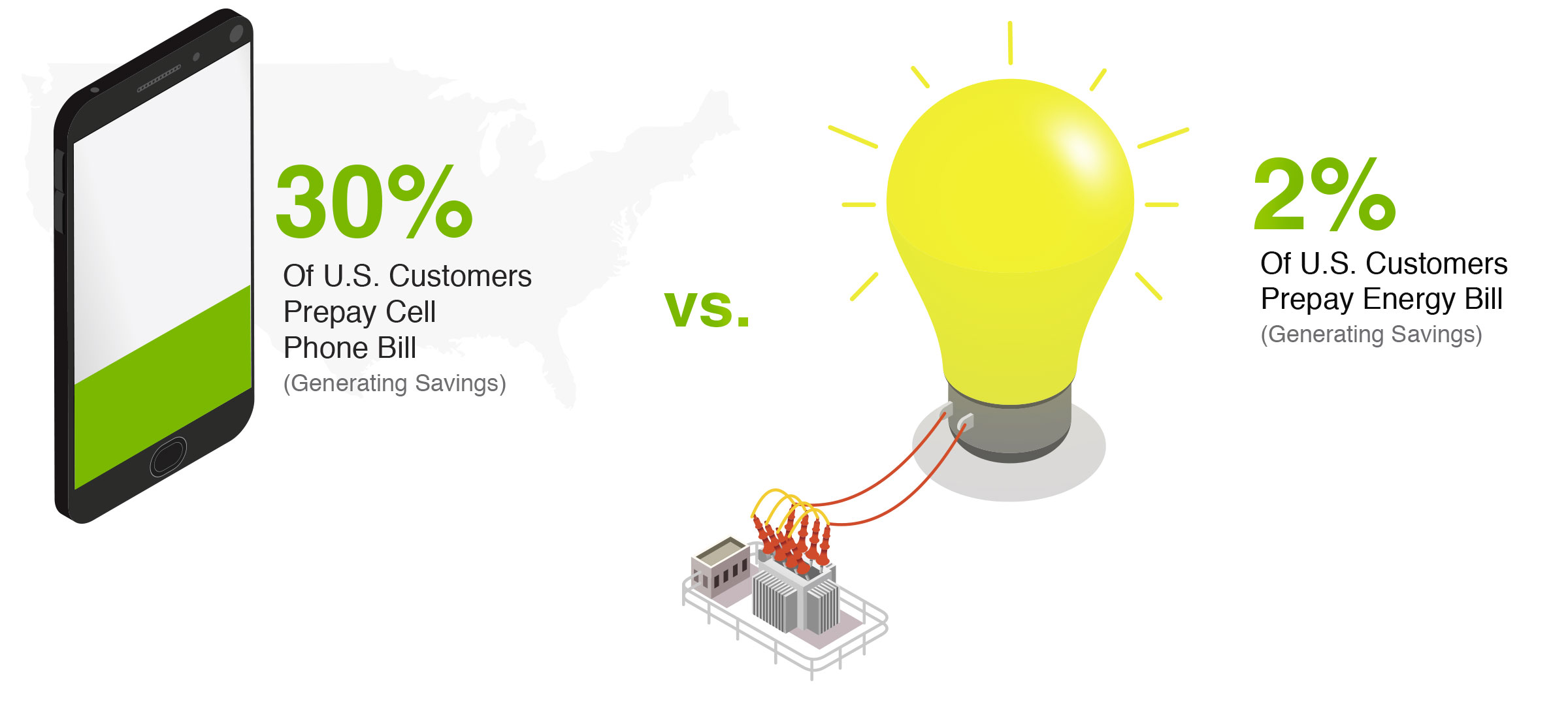

“Believe it or not, prepayment is the most expensive way to buy energy today in the U.K.,” says Mueller. “In the future, with smart grids, it will be more efficient for retailers to offer prepayment contracts and, therefore, the adoption rate might be higher.” By contrast, in the U.S., where prepay has made some inroads, especially at cooperatives that have made it a priority, it is actually a less expensive option for consumers with credit or late payment histories. However, only 2 percent of U.S. customers use prepay, whereas nearly 30 percent of U.S. customers prepay their cell phone bills. It seems customers have yet to see how the concept applies to their energy costs — something for utilities to consider as they develop and communicate other payment and pricing strategies.

Does Transparent Pricing Have a Future in the U.S.?

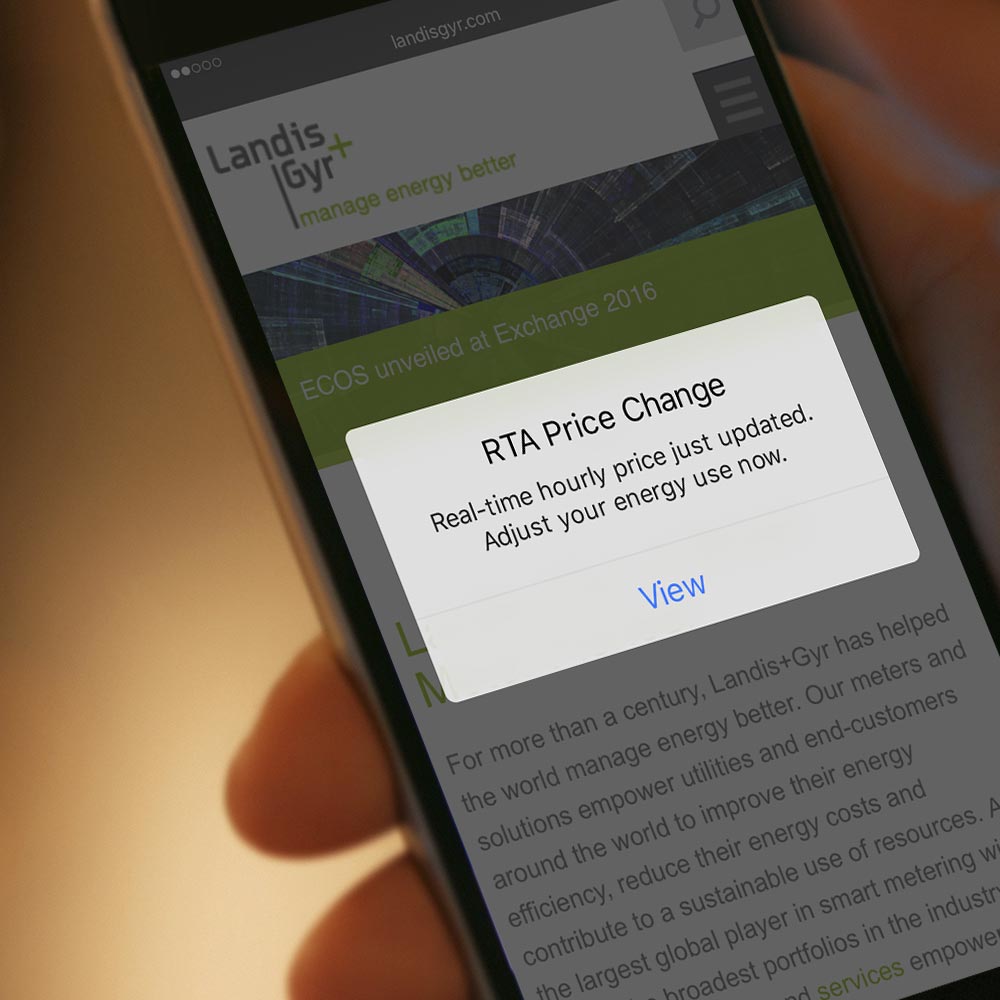

While prepay struggles to gain traction, consumers continue to demand more control of the cost of energy. Some U.S. energy providers are exploring new time-varying rates to help reduce consumption and cost. These include TOU, which comprises predefined peak and off-peak periods and a tiered pricing structure, as well as real-time pricing (RTP), with hourly prices determined by spot market prices or day-ahead market prices for electricity.

With RTP, customers receive a price signal for each short interval in which the price of electricity changes. In most cases in the U.S., RTP is provided only to larger commercial customers, although Commonwealth Edison and Ameren in Illinois have started to implement RTP pricing for their residential customers.

While time-varying rates are still not widely available in the U.S., many utilities are beginning to realize the benefits that dynamic rate structures can contribute to a more efficient energy system.